Rethinking an Urban Campus

Rethinking an Urban Campus

Chicago, Illinois | Spring 2020

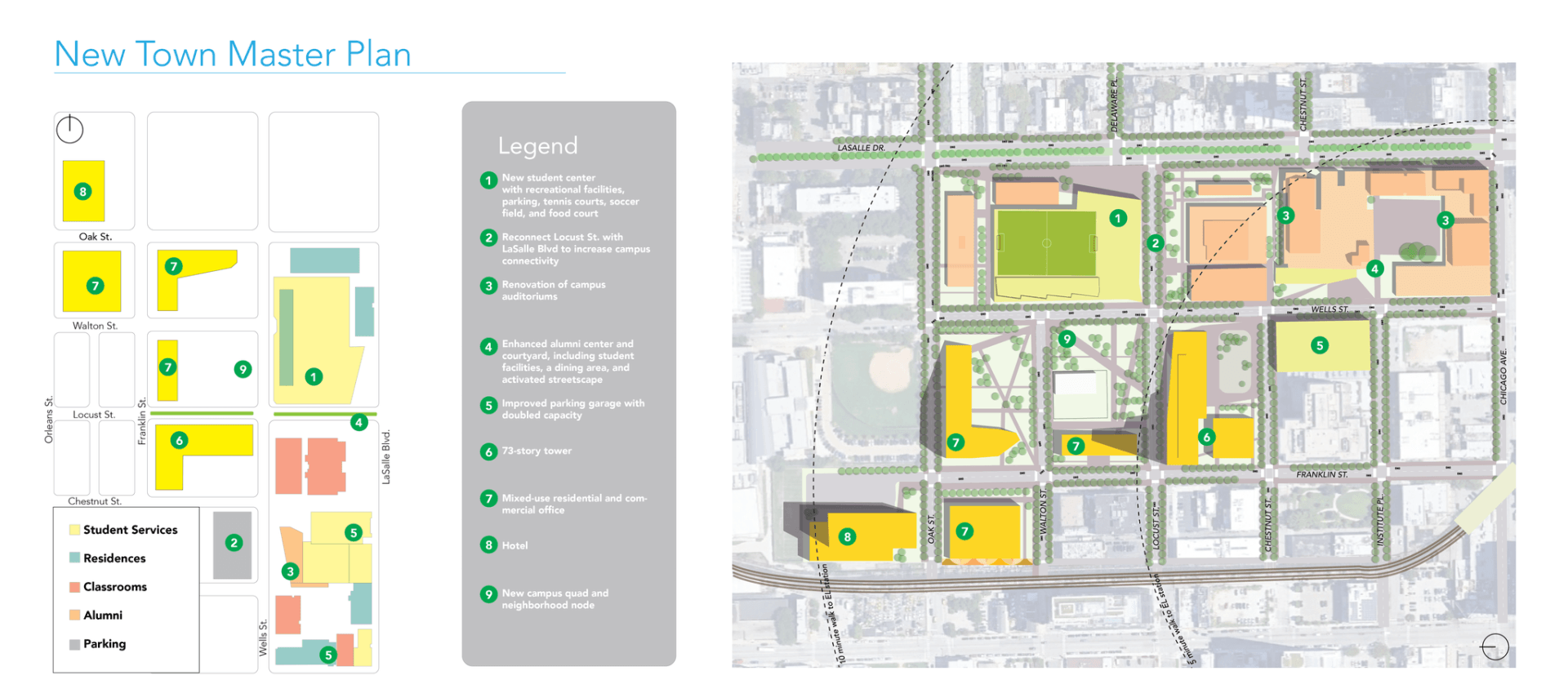

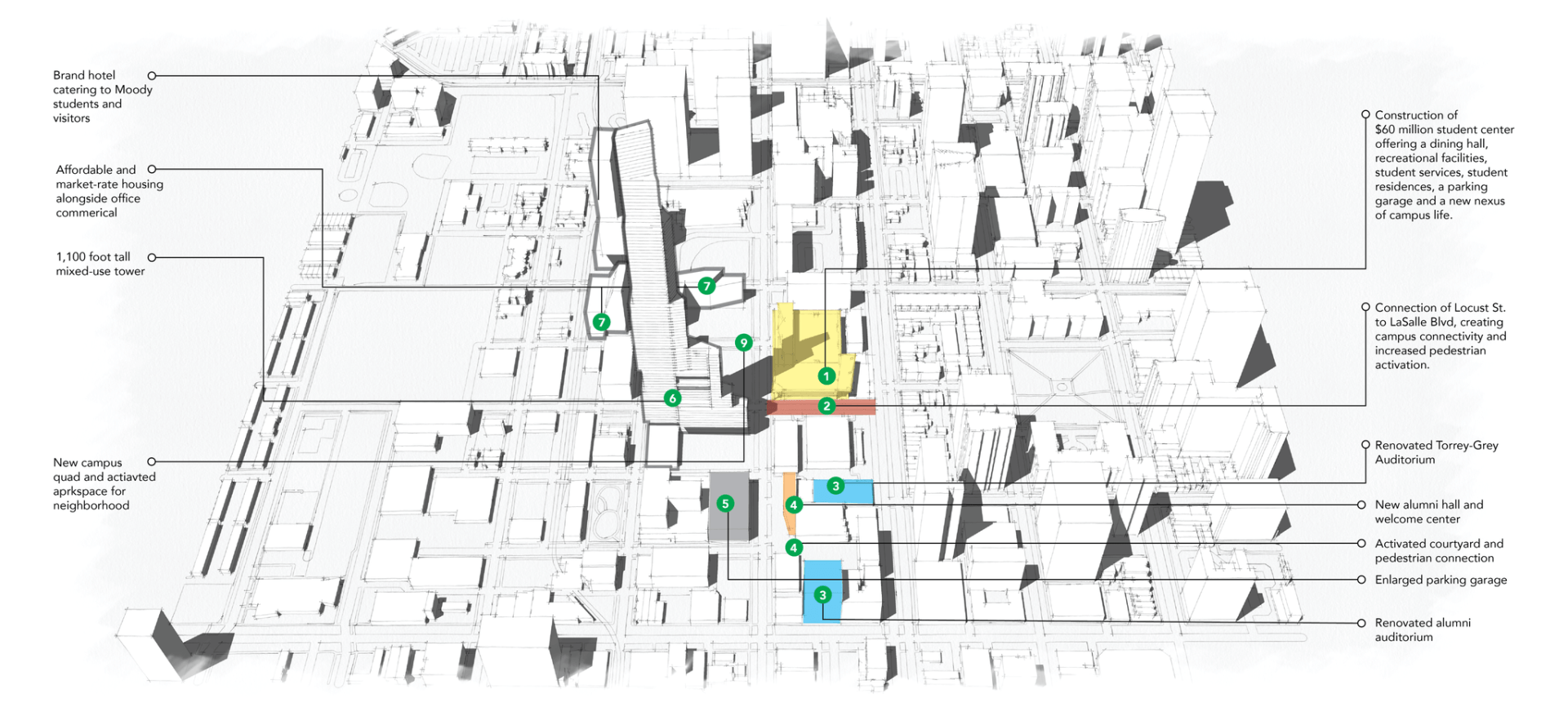

As part of a real estate competition, our team was tasked with constructing a development and master plan of 10 acres of the Moody Bible campus in Chicago. The proposal outlined a market analysis, site analysis, and urban design to rethink the campus as a 21st century creative incubator. Rigorous financial feasibility and multi-phase proformas to justify development were expected. Coined the Mosaic District, our proposal offered a creative partnership between a development group and Moody Bible, ensuring a handsome return for both parties and a $200 million+ investment in Moody’s future campus.

Goals

Goals

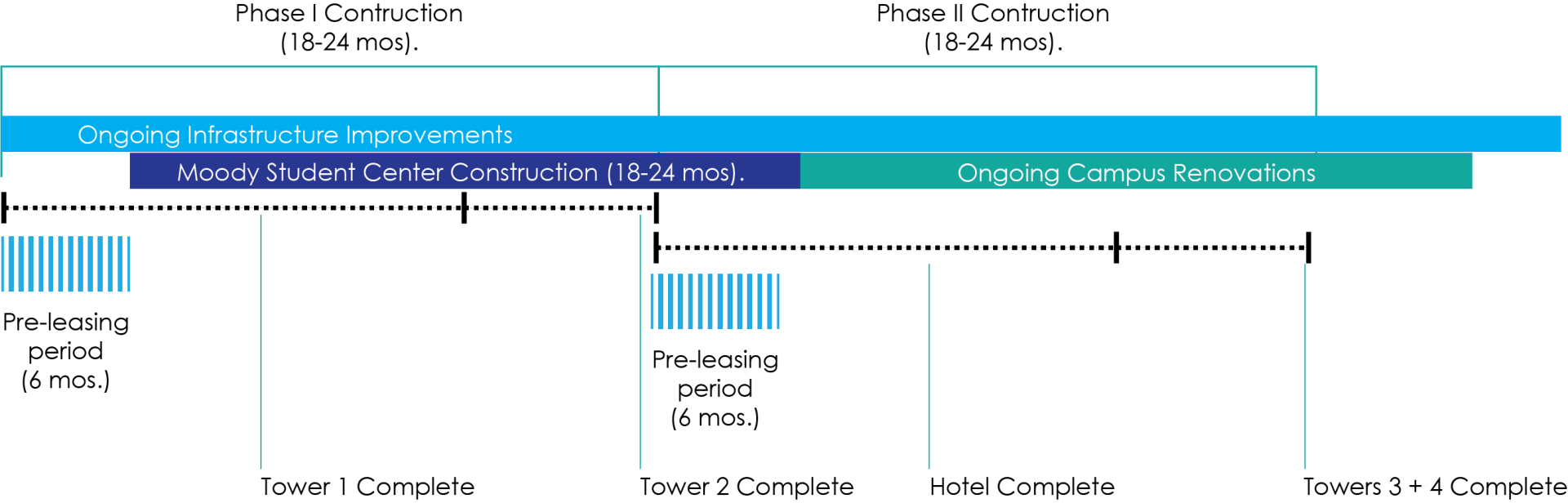

Submissions were expected to present a detailed analysis incorporating a creative, but feasible financing plan that addresses scope, timeline, infrastructure considerations, connectivity to the neighborhood, operations and maintenance, impact and fringe benefits – among other factors. The development of the Mosaic District will catalyze a dynamic, mixed-use economic engine for the City of Chicago. The vision includes a diversity of use and program that will support dynamic and inclusive growth for the city. Phase I would include a 73 story tower and new student center while the second phase would include complementary residential and hotel uses.

A Financial Win-win

While Moody would retain ownership of the land, the developer would be expected to payout Moody throughout the duration of the partnership. This could potentially pay Moody more over time than a flat initial payout, with an estimated Year-7 payout of $203,964,056 from Phase I of the project, with residual equity payments occurring from Phase II.

PRT's model also provides the developer flexibility and risk aversion, more so than a traditional development model offered by Model I, in which the investment group would have to be willing to sacrifice short-term profit for long-term gain, with diminished returns due to high acquisition cost. In keeping with preferred FAR calculations for the district, a traditional model would maximize all parcel space to garner a decent return, which would probably exceed suggested FAR. While our development plan could have exceeded the square footage this plan calls for, our plan retains plenty of open space as a community, campus, and neighborhood amenity which should ensure higher demand and eschew risk as building over the 1.5 million square feet could run the risk of oversaturating the market. With initial cost of $373,772,629, and adjusted sales price of $786,645,670 in Year-7, the development courts an Unleveraged IRR of 21.68% and a Before-Tax IRR of 53.04% with an After-Tax IRR of 43.16%. The investment group should expect a Net Operating Income (NOI) of $47,971,119 and an overall investor Before-Tax IRR of 47.13% with a 37.53% ROE. Including Moody as a partner ensures the school a Net Present Value of $95,925,709. Our Phase II which calls for further residential occupancy amongst retail and hotel offerings helps to diversify the economic output of the future development and helps mitigate risk by breaking the project up. Profitability is ensured even with the inclusion of affordable units. Total project cost of Phase II is $139,075,135 and includes more than an additional $10 million for infrastructure improvements. As the entire site is within a TOD zone, additional grant and TIF funding should be acquired. The Leveraged 10-Year IRR stands at 37.92%, and accounting for an equity payment for Moody, the Leveraged investment ROE is 28.11%.

Related Projects

Related Projects

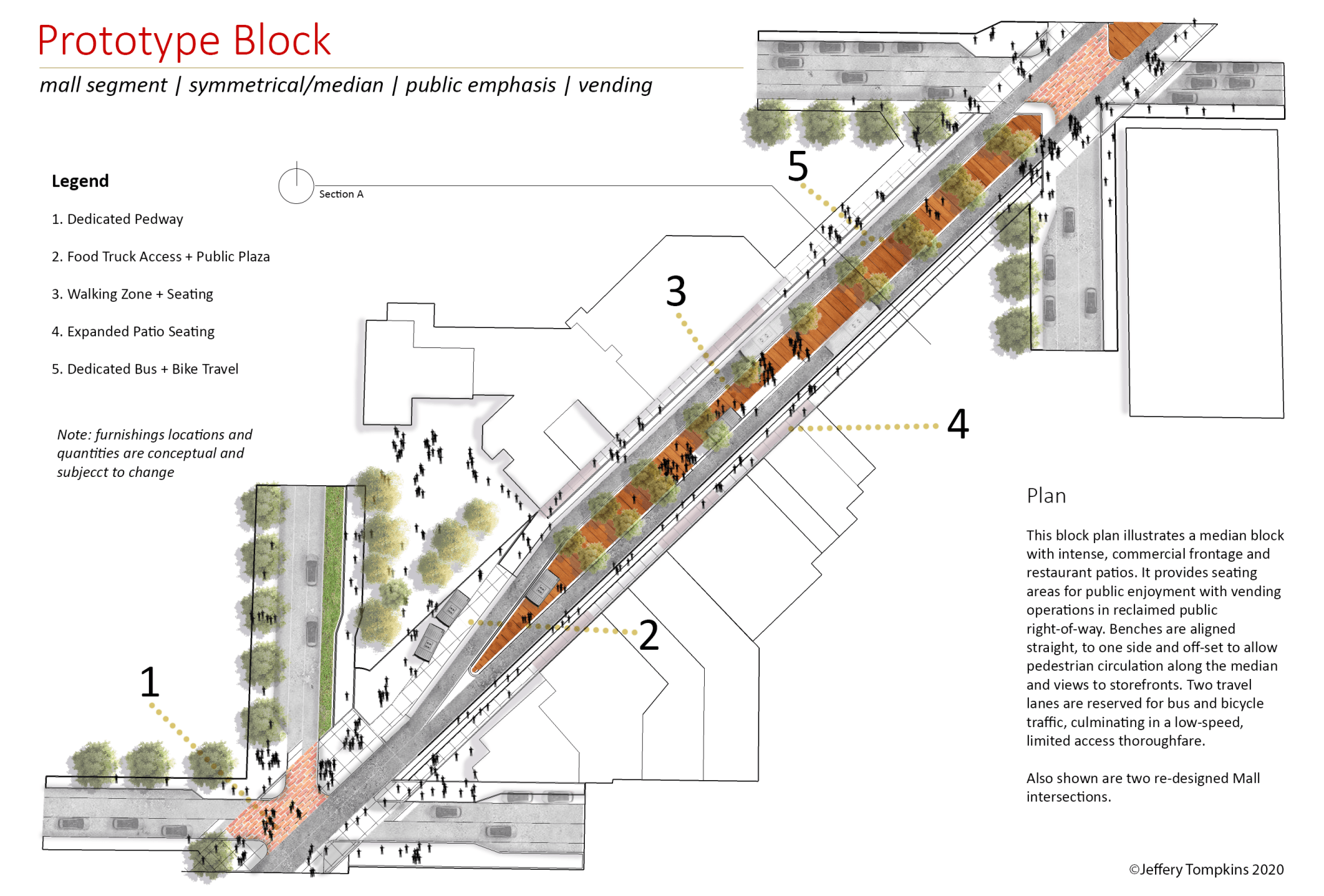

A New Mass Ave

Title or short description